Create Pay Stubs Instantly Online

Create Pay Stubs Instantly Online

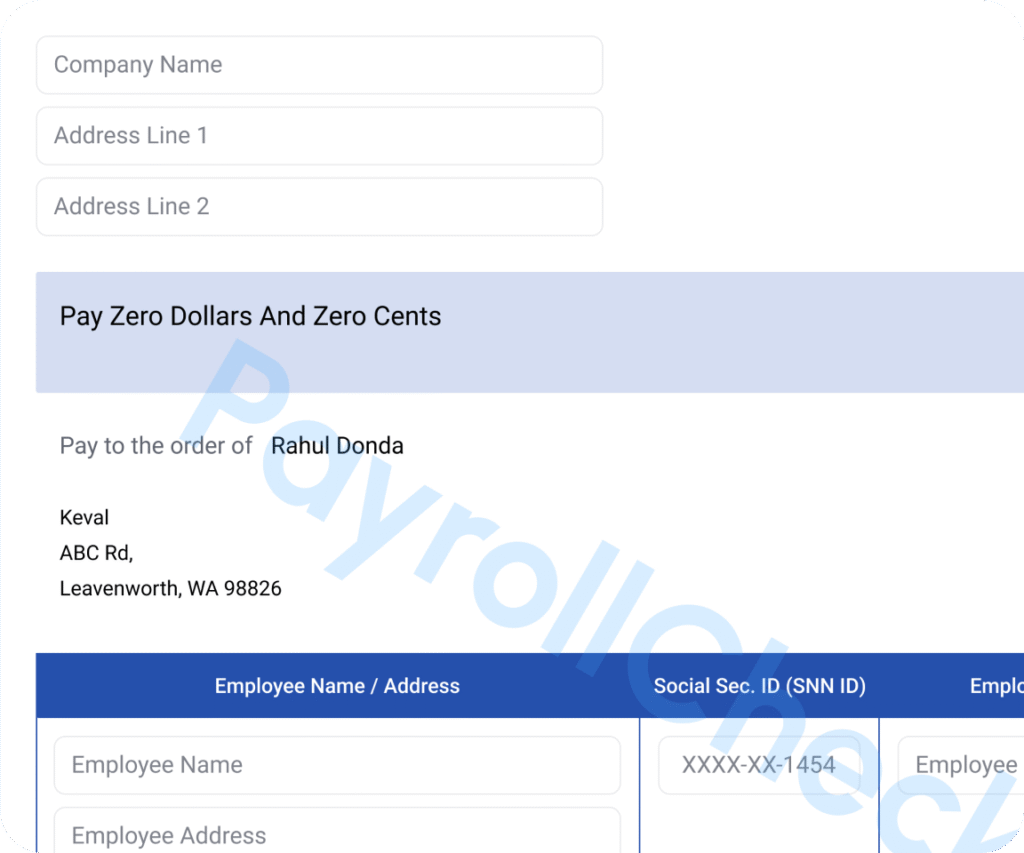

Simple Payroll Check Stub Generator for Employees. Create Your Pay Stub in 3 Quick Steps!

Create Your Pay Stub in 3 Quick Steps!

Get Started With Our Payroll Check Stub Generator

Create the perfect pay stub for your employees with our free online payroll stub generator. It’s fast, easy to calculate, generate, and print all in just a few clicks!

Get your 1st default stub free*

Get your 1st default stub free*

Get Free Corrections

Get Free Corrections

100% secure payment with PayPal

100% secure payment with PayPal

Get $4.99 OFF on your first order

Get $4.99 OFF on your first order

24/7 customer support

24/7 customer support

Resolution of query in 24 hours

Resolution of query in 24 hours

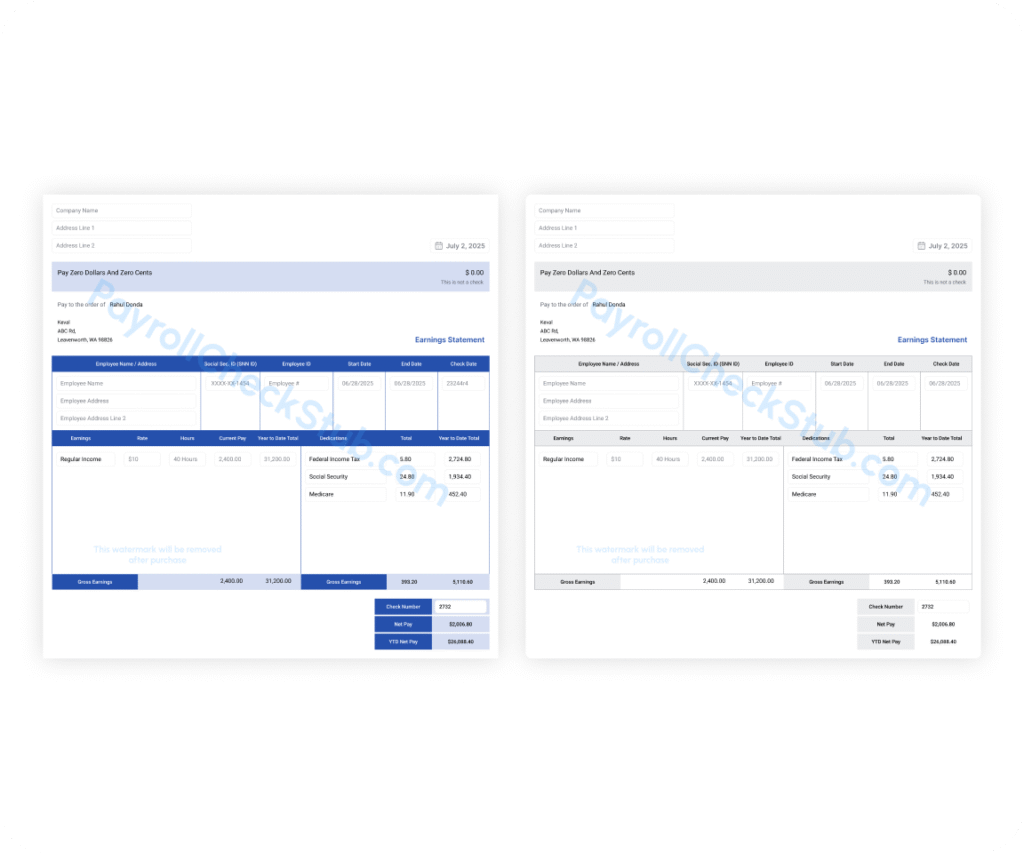

Instant delivery by email and download

Instant delivery by email and download

Seamless automated calculations

Seamless automated calculations

Smart Calculations

Smart Calculations

First stub is free. Additional stubs just $4.99

What is a Paystub Generator?

- A pay stub, also known as a pay slip or pay statement, is a document detailing an employee’s earnings and deductions for a specific pay period. It serves as proof of income and helps employees track their salary, taxes, and other deductions. It also allows them to verify the accuracy of their pay and identify any potential errors.

- In essence, a pay stub is a document that you retain after receiving your paycheck. It not only acts as verification of your earnings but also allows you to monitor details such as your salary, taxes withheld, and any overtime compensation.

How Does Our Payroll Check Stub Work?

Step 1

Step 2

Step 3

Why Our Pay Stub Maker is the Right Choice?

Trusted by Thousands of

Happy Customer

Join over 1,200,000 satisfied users who have effortlessly generated their pay stubs with our easy-to-use tool.

Finally, a tool that works without any hidden fees!

My accountant even complimented how professional the stub looked!

User-friendly and reliable—created multiple stubs for different jobs I do.

I used this to generate a pay stub for my nanny. It was perfect.

I’m self-employed and this generator makes my life much easier.

Fast download and customizable. Love it!

Worked great for providing proof of income for a car lease.

It calculated taxes and deductions automatically!

So helpful and easy! I’ll be using this every month.

I needed a last-minute pay stub for my visa application. This worked perfectly.

Benefits

Our paycheck stub calculator helps you efficiently manage your finances, secure bank loans, obtain credit cards, and use your stub as both proof of income and a reliable employment reference.

Need Help? Chat with Us

24/7 Customer Support

Send Email Now

A Simple Guide to Employee Pay Stubs

Who Should Use a Pay Stub?

Employees

Employers

Entrepreneurs

Are Employers Required to Provide Pay Stubs?

Why Fake Pay Stubs Can Get You in Trouble?

What Is The Difference Between Real And Fake Pay Stubs?

- Legal penalties – Falsifying financial documents is considered fraud and can result in criminal charges.

- Fines and restitution – Individuals may face hefty fines and be required to repay any benefits or money obtained through deception.

- Loan or rental denial – Banks, landlords, and lenders may immediately reject applications if fraud is suspected. Employment termination – Submitting fake documents during background checks can lead to dismissal or disqualification from job opportunities.

- Employment termination – Submitting fake documents during background checks can lead to dismissal or disqualification from job opportunities.

- Criminal record – A fraud conviction can stay on your record, impacting future employment, housing, and financial trustworthiness.

- Reputational damage – Getting caught using fake documents can severely harm your credibility, both personally and professionally. Worried Yet? You Should Be. With the risks of using fake pay stubs on the rise, it’s more important than ever to avoid shady platforms and illegitimate pay stub generators. Protect your business, your employees, and your reputation by choosing a trusted, verified, and well-reviewed pay stub maker.

Do I Need A Paystub Generator?

Disorganized payroll system

Unsatisfied Employees

Staff shortage

How a Pay Stub Generator Simplifies Remote Payroll Management

Use The Best Technologies For Your Business

- Payroll management solutions

- Attendance tracking systems

- HR software

- Payment processing software

Measures of Business Success

Several Errors/Accuracy Rates

- Differences in Salary and Payment Types – Understand the nuances between hourly, salaried, commission-based, and freelance payments to ensure accurate calculations and reporting.

- Time Tracking Accuracy – Ensure precise time tracking for both hourly and salaried staff, especially when dealing with overtime, leave, or hybrid work setups.

- Tax and Fee Compliance – Accurately withhold and remit taxes at the federal, state, and local levels, along with applicable employer contributions and fees.

- Specific Deductions – Account for all relevant deductions, including benefits, garnishments, retirement contributions, and other withholdings.

Labor Expense

The Process for Making Pay Stubs